You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Post a photo, any photo

- Thread starter MonteroRed

- Start date

Help Support Winemaking Talk - Winemaking Forum:

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

Sadly it seems that in today's new world reality the only sure stock to invest in are guns and ammo.............

wineforfun

Still Trying To Make The Perfect Wine and Now Tryi

- Joined

- Nov 5, 2012

- Messages

- 2,707

- Reaction score

- 898

That is what the 'gamble' is about, at my age, 49, I have to play risky but I think I have a balanced portfolio.

If you are into mutual funds, get index funds. Only way to go in mutuals.

jswordy

Senior Member

- Joined

- Jan 12, 2012

- Messages

- 10,086

- Reaction score

- 35,614

If you are into mutual funds, get index funds. Only way to go in mutuals.

As far as stock prices, my uncle - a retired stockbroker - told me all I need to know when he said, 'There are only two times a stock has a real price - when you buy it and when you sell it. All that other stuff in between means nothing."

I am normally a very slow and reluctant trader, but I've been selling off stocks on this rise that are up 100 percent or more. The rise should be just about over, but who knows? I am happy to take my profits. Oh, but I might miss more rise? I'm not so greedy as to think 100 percent plus isn't a good profit even if I leave some gain there. And the cash will be sitting there for the next valley.

For the hands-off investor, indexed ETFs are the way to go. Exchange traded funds sell just like stocks, and the fees are very low. Check out Vanguard's offerings for extremely low fees. You can buy the whole market or just sectors of it. They track the performance of the market or sector.

For example, in my IRA account, a successful ETF has been Health Care Select Sector SPDR Fund (XLV). Following the advice of Warren Buffett to be greedy when others are fearful and fearful when others are greedy, I bought it when everyone predicted Obamacare would ruin the health industry.

After the election, a recession is already baked in. The bull is old by historical standards and I think we will see softer days ahead heading into 2017. It will be a good time to have saved cash on hand for opportunities, I think. Your mileage may vary.

As far as stock prices, my uncle - a retired stockbroker - told me all I need to know when he said, 'There are only two times a stock has a real price - when you buy it and when you sell it. All that other stuff in between means nothing."

I am normally a very slow and reluctant trader, but I've been selling off stocks on this rise that are up 100 percent or more. The rise should be just about over, but who knows? I am happy to take my profits. Oh, but I might miss more rise? I'm not so greedy as to think 100 percent plus isn't a good profit even if I leave some gain there. And the cash will be sitting there for the next valley.

For the hands-off investor, indexed ETFs are the way to go. Exchange traded funds sell just like stocks, and the fees are very low. Check out Vanguard's offerings for extremely low fees. You can buy the whole market or just sectors of it. They track the performance of the market or sector.

For example, in my IRA account, a successful ETF has been Health Care Select Sector SPDR Fund (XLV). Following the advice of Warren Buffett to be greedy when others are fearful and fearful when others are greedy, I bought it when everyone predicted Obamacare would ruin the health industry.

After the election, a recession is already baked in. The bull is old by historical standards and I think we will see softer days ahead heading into 2017. It will be a good time to have saved cash on hand for opportunities, I think. Your mileage may vary.

I think Will Rogers had the best advice on the stock market: "Buy good stocks when they are low. When they go up, sell them. If they don't go up, don't buy them."

wineforfun

Still Trying To Make The Perfect Wine and Now Tryi

- Joined

- Nov 5, 2012

- Messages

- 2,707

- Reaction score

- 898

'There are only two times a stock has a real price - when you buy it and when you sell it. All that other stuff in between means nothing."

be greedy when others are fearful and fearful when others are greedy

Two best pieces of advice right there. Sad thing is very few adhere to them.

I'm slowly getting involved in a group from our church who helps take care of a historic church. It is called Rock Chapel and is the oldest Methodist Episcopal Church west of the Susquehanna. It's cornerstone was placed in 1773 (but took a few year more to get completed). They needed some images for posting on an event forum, so I went out Saturday morning (too hazy) and then stopped before church on Sunday. Needed a nice blue sky background for the steeple. It is well maintained for how old it is and has some history from Civil War days (lot's of Confederate troop divisions were around, just north of Gettysburg). I've attended a few Christmas Eve services, and they are quite intense, only kerosene lanterns but nice acoustics inside.

- Joined

- Mar 1, 2009

- Messages

- 20,302

- Reaction score

- 2,223

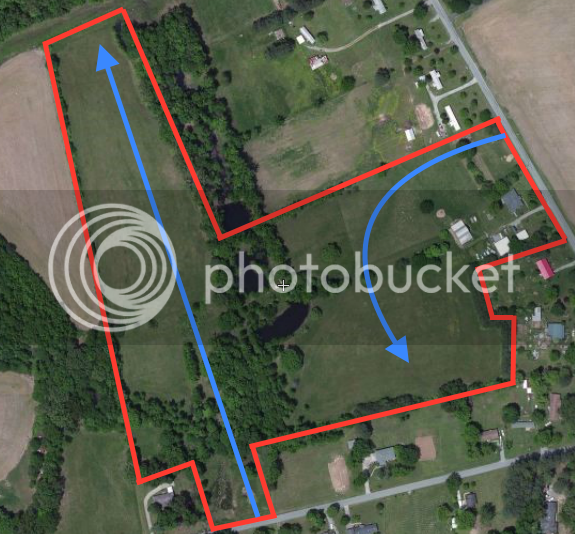

what are we looking at, your farm?

what are we looking at, your farm?

first three holes at tennessee national golf course?

Looks like a nice place for a vineyard to me.

Amazing photo from Monday afternoon. Microburst formation during a monsoon rain in Phoenix, AZ.

jswordy

Senior Member

- Joined

- Jan 12, 2012

- Messages

- 10,086

- Reaction score

- 35,614

what are we looking at, your farm?

Roger that!

jswordy

Senior Member

- Joined

- Jan 12, 2012

- Messages

- 10,086

- Reaction score

- 35,614

jswordy

Senior Member

- Joined

- Jan 12, 2012

- Messages

- 10,086

- Reaction score

- 35,614

Looks like a nice place for a vineyard to me.

It used to have muscadines all over the front, back in the day.

olusteebus

Senior Member

- Joined

- Mar 5, 2012

- Messages

- 2,329

- Reaction score

- 1,413

what are we looking at, your farm?

Actually, that is a secret military photo of an area in Tennessee that has long been a subject of investigations of space aliens landing there. It is suspected that not only did they land there, they set up a colony and some inhabitants are still there. Not many people no about it but the neighbors are very suspicious. They know that those inhabitants are having a tough time assimilating.

Actually, that is a secret military photo of an area in Tennessee that has long been a subject of investigations of space aliens landing there. It is suspected that not only did they land there, they set up a colony and some inhabitants are still there. Not many people no about it but the neighbors are very suspicious. They know that those inhabitants are having a tough time assimilating.

The problem with this theory are the missing crop circles...

Similar threads

- Replies

- 0

- Views

- 267